As laundry operators plot their business strategies for 2026, Textile Services Weekly asked several experts for their take on what the industry can expect in the coming year and how laundries across North America can overcome a range of challenges.

Economists have described the current business climate as, at best, unpredictable. A popular acronym introduced by the U.S. Army War College in 1987 described the situation at the end of the Cold War as a time of “volatility, uncertainty, complexity and ambiguity” (VUCA). Chris Welch, president of Prudential Overall Supply, Irvine, CA, shrugged off our query when we asked if the term is applicable to the current economy. Today’s market isn’t all that different from the routine challenges that face laundry operators. “There’s no change from how you regularly manage your business,” said Welch, whose national company specializes in industrial garments, including cleanroom operations. “The environment is always ‘VUCA.’ You just may not be aware of that fact. Having solid cash flow, marginal or no-debt leverage, and effective operations allows you to do many things without regard to any underlying economic turbulence. Being faithful to organizational core principles and your mission statement goes a long way in accomplishing this over distant horizons.”

In a slightly different reading, Brandon Rosenblatt, CEO of Commercial Laundry, a hospitality operator in Baltimore, says laundry executives should focus on those issues they can address, while monitoring market developments closely. “Worry about the things you can control, but also do your best to ‘skate where the puck is going,’” he said paraphrasing hockey great, Wayne Gretzky.

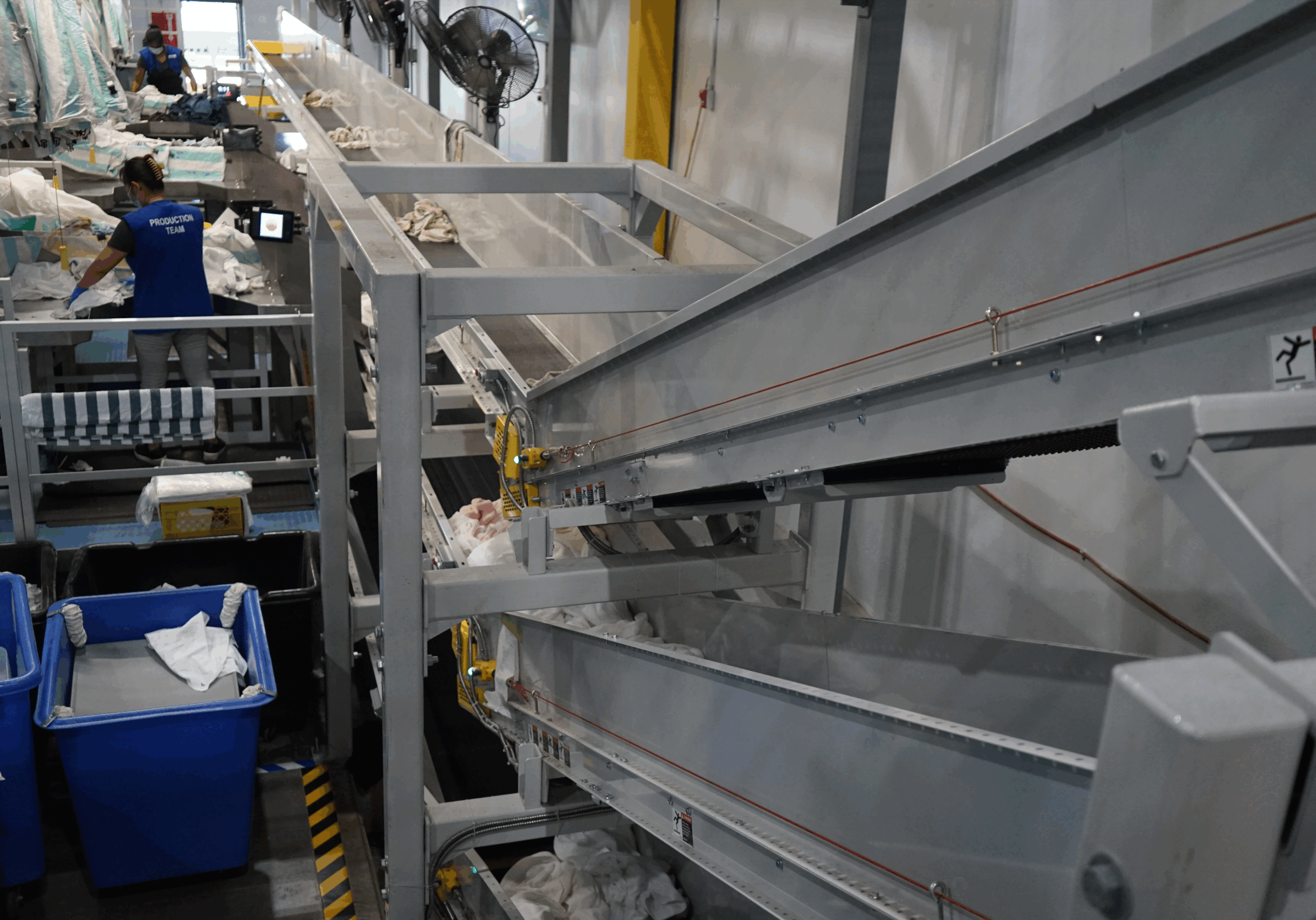

Consultant Gerard O’Neill, who’s overseen the design and construction of more than 100 plants over 20-plus years, recommended that operators first address what they can improve internally, as a hedge against market uncertainties. “What I’m telling customers is make sure that their house is in order,” said O’Neill, who is president and CEO of American Laundry Systems, Derry, NH. “So instead of looking at other buildings or expansions, there’s always internal improvements to be made that can make you more efficient and able to handle the rough waters ahead.” Many operators miss opportunities to improve their operations and lower costs because they don’t look at issues such as fixing leaks, he said. “They’re always looking outside, and you know the faraway hills are greener.”

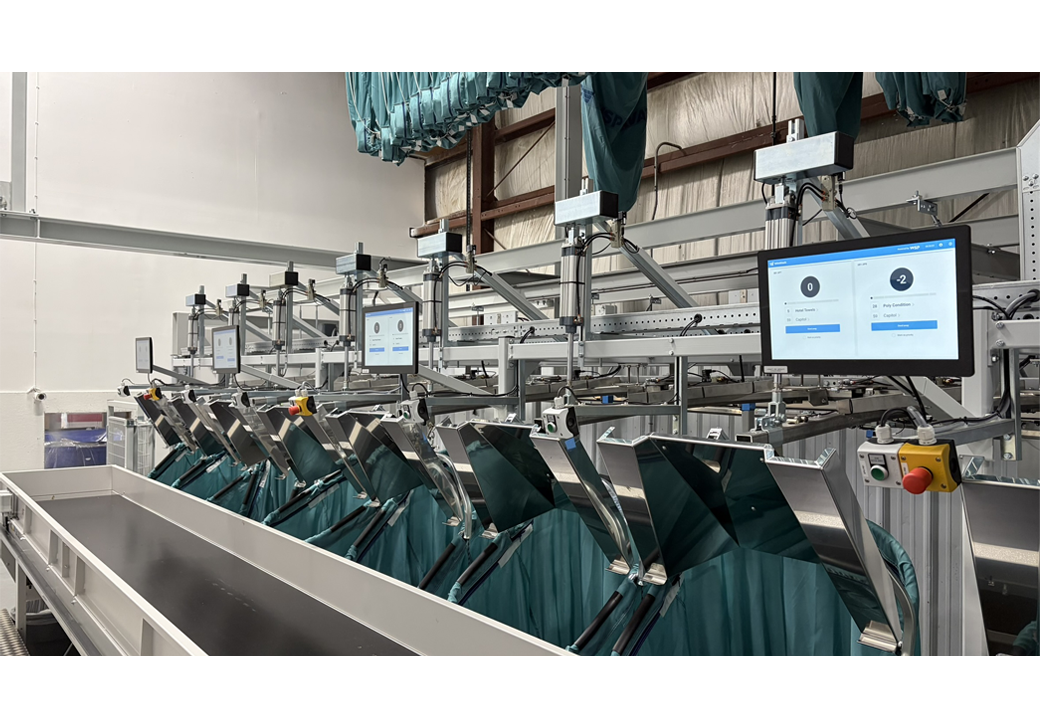

A key issue confronting operators – both internally and externally – is automation, said Andrew Wittmann, senior research analyst for Baird Equity Research, Industrial Services, Milwaukee. He said automation can generate a significant return on investment (ROI) for operators who want to improve both operations and service capabilities. “Automation is increasingly important,” said Wittmann, a co-author of Baird’s quarterly surveys of the linen, uniform and facility services industry. “Over the years, automation has gone from a cost-savings focus. Now I would say digital automation is increasingly important and has real customer-service benefits. Customers are now expecting the ability to interact digitally with their providers, whether it’s for service calls, billing or just to communicate.” He added that automating plants represents a significant “net present value” (NPV, i.e., potential for ROI). He further emphasized that, “Customer interaction is also part of automation and has real impacts on growth and retention.”

Rosenblatt said another factor in considering automation is a laundry’s ability to compete in an age of rising labor costs and scarcity. “I believe this depends on your market, the competition and a host of other factors, including the regulatory environment and minimum wage,” he said. “We are in a highly competitive high-wage market. So we have felt and continue to feel a sense of urgency to keep pace with market trends. Our response has generally been to invest further in technology and automation. We believe long term that will be the winning strategy across most, if not all, markets.”

Welch said his company is also looking to leverage technology, including artificial intelligence (AI), to save labor and reduce the amount of routine work that staff are now doing. “We are taking an ‘early-adapter’ approach and looking for multiple opportunities to ease, lessen or eliminate the need for human labor in every area of production,” he said. “Coupling this with AI to reduce mundane tasks in a service or administrative role allows us to focus our talent on what drives value in the business.”

On that note, Wittmann said whether a company emphasizes automation or other improvements, it’s critical to keep focused on delivering customer value as your top priority – especially in times of economic uncertainty. “Ultimately, focus on what your customers need as the guiding light,” he says. “Where possible, look first at areas in central costs, supply chain and in the plant that don’t directly impact the customer experience.”

Watch for follow-up coverage of these issues in Textile Services magazine.

Sign Up For Our Newsletter

Receive the latest updates on the linen, uniform and facility services industry from TRSA delivered straight to your inbox.