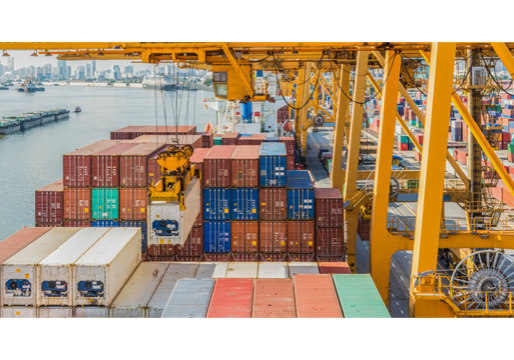

Several U.S. laundry operators and suppliers recently have expressed concerns to Textile Services Weekly that a surge of global instability could fuel supply-chain delays, including deliveries of textiles to laundries across North America.

“I have been in touch with colleagues and counterparts in manufacturing and logistics in Asia who are also concerned about the current situation,” said Ammar Khan, president, Calderon Textiles, Indianapolis. “The supply-chain situation in Asian ports, particularly Singapore, is indeed a matter of concern right now.”

Various linen, uniform and facility services industry sources have said that the reason for the tie-ups in Singapore stems from concerns about pending tariffs on a range of nontextile goods moving from China to the U.S. On May 14, President Joe Biden (D) announced the tariffs. A White House statement said Biden was exercising his authority under the section 301 of the Trade Act of 1974 on some $18 billion worth of imported goods from China due to unfair trade practices. These products range from electric vehicles, batteries and semiconductors to steel and aluminum, plus medical products and more. For example, the new tariff on electric vehicles will rise from 25% to 100%. Tariffs on select steel and aluminum products will rise from zero to 7.5% currently to 25%. Some tariffs will take effect next year, while others, including electric vehicles and steel will take effect in 2024. The new tariffs are expected to begin within 90 days of the May 14 announcement, according to news reports citing the U.S. Trade Representative’s Office. The new tariffs will come on top of some $300 billion in tariffs on Chinese goods imposed by former President Donald Trump. The Biden administration is expected to keep the Trump tariffs in place, according to news reports.

In response, Asian suppliers are trying to get goods to customers before the new tariffs hike costs. The resulting spike in demand for ocean-going traffic is raising freight costs. That push also has fueled traffic jams in East Asia, Khan said. “Asian ports, including Singapore, are experiencing significant congestion,” he said. “This is partly due to an increase in shipments from Chinese exporters who are trying to move goods ahead of potential new tariffs by the Biden administration. From my understanding, a lot of the influx is related to electric-vehicle tariff avoidance.”

Another factor that has lengthened lead-times for ocean shipping is the continuing threat of attacks by Houthi rebels from Yemen on container ships moving through the Suez Canal. The latest attack earlier this month sank the Tutor, a Liberian-flagged Greek-owned-and-operated vessel. The incident claimed the life of a merchant mariner. Houthi rebels announced the attack on June 19; it came despite a beefed-up effort by U.S.-led naval forces seeking to protect the region’s shipping lanes.

As the risk to ocean shippers increases, some have chosen to transport goods around the horn of Africa. This of course adds time and expense for customers of global shipping. David Cole, director of procurement, Healthcare Linen Services Group (HLSG), St. Charles, IL, cites “Suez Canal re-routing” as a significant factor in the spike in demand for ocean freight. “There are 15%-20% more vessels than normal in use due to the increases in transit time on the longer shipping route around Africa,” Cole said. “This causes more constraints on vessel and container availability.” To avoid service-level impact, suppliers are paying more to get goods from Asia to North America, he said. “In some cases, suppliers may pay premium rates to ensure our deliveries stay on time. Suppliers are reporting that container costs have gone from $2,800 to $8,000 in some cases.”

In the aftermath of COVID-19-driven port tie-ups, many shippers are taking steps now to keep deliveries flowing. “The chaos of port congestion and lack of capacity during COVID is still in the minds of shippers,” Cole said. “With the Red Sea conflict increasing demand, there is fear that the squeeze on capacity in the peak season of Q3 is leading some of our suppliers to import inventory early. The thought process is that holding inventory is more palatable than the risk of goods arriving too late.”

On an upbeat note, Cole said he’s hearing that suppliers expect the situation with global supply chains to stabilize this fall. “Suppliers believe that June and early July will be the most-challenging period,” he said. “Late July it will improve, and by September carriers should be back to more consistent service.”

One other factor in international-trade flows that could affect laundry operators is the fact that if the current disruptions in ocean shipping persist, the seasonal rush of retail trade in the second half of this year could further complicate efforts by commercial launderers to get textiles and other goods from Asian suppliers.

“The global ocean-delivery situation remains volatile,” said Paul Rasband, director of mergers and acquisitions/supply chain for Alsco Uniforms, Salt Lake City. “We continue to closely monitor the situation. At this point, we have not taken any specific action to mitigate challenges related to Singapore, since problems are so difficult to foresee and understand at this point.” In a cautionary note, Rasband adds that, “My biggest concern is actually the U.S. West Coast ports, primarily LA/Long Beach. I’m concerned that the large U.S. retailers will try to bring in substantial amounts of product in advance of any new U.S. tariffs. I always remember that the retail world swamps the institutional world when it comes to product.”

How should operators manage these risks amid today’s threats to supply-chain stability? Tom Baron, a longtime laundry operator who now works as a consultant, suggests stepped-up collaboration with distributors. “I think it is very important for laundries to work closely with their distributors and have a forecasting plan updated quarterly, so that the distributors can plan and order accordingly,” said Baron, who is based in Ft. Lauderdale, FL. “We are not having issues getting containers or with deliveries. But we are letting our customers know that there will be a 2-3 week delay for multiple reasons. There are many moving parts as to why this is happening – not to mention that rates have gone from $2,500 to almost $10,000 a container right now.”

Sign Up For Our Newsletter

Receive the latest updates on the linen, uniform and facility services industry from TRSA delivered straight to your inbox.