Robert W. Baird & Co. and TRSA released the results of their Second-Quarter 2025 Uniform & Linen Rental Survey. Healthcare and linen rental results remained generally positive compared to last quarter, while a key indicator ticked upwards on the uniform rental side of the business for the first time since the March 2024 survey.

SECOND-QUARTER 2025 UNIFORM RENTAL SURVEY HIGHLIGHTS

- Revenue trends are mixed, but more respondents see trends below expectations. 30% of respondents reported revenues below expectations in the second-quarter survey while just 13% reported revenues ahead of expectations. However, 57% of responses met expectations. Baird sees this as consistent with general stability on the uniform side of the business.

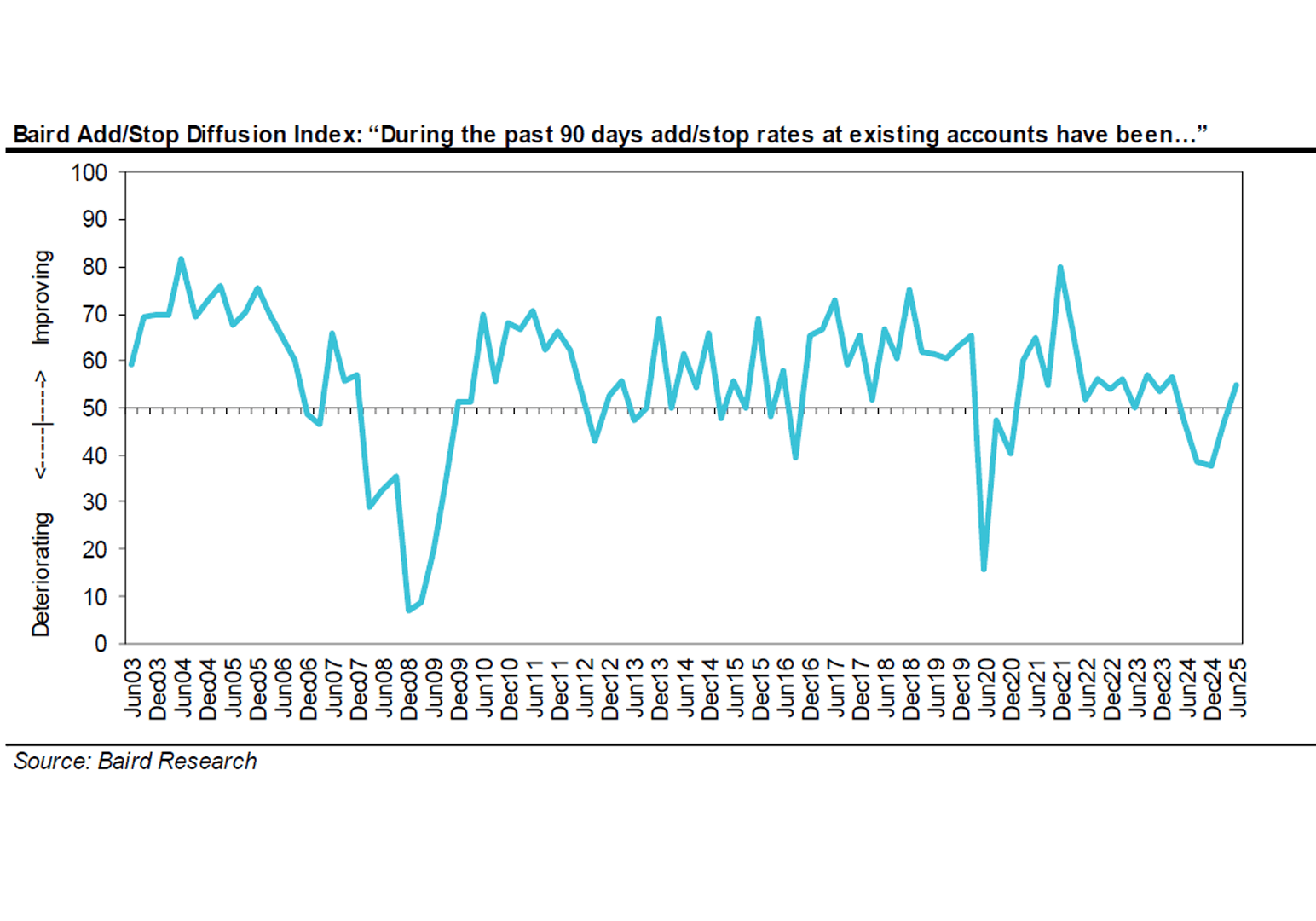

- Add/Stops turned slightly positive. Employment-driven expansion at existing accounts (i.e., Add/Stop Diffusion Index) was positive (54.8) for the first time since March 2024. Employment-driven gains at existing accounts are typically among the most profitable sources of growth and thus a key metric Baird monitors in its quarterly surveys.

- Revenue growth expectations are down slightly, but mostly the same as recent quarters. Respondents expect a 3.2% rental revenue growth over the next 12 months, down from 4.1% last quarter, which was the strongest outlook in a year. Previous quarters generally forecast a roughly 2-3% revenue growth outlook, so we see today’s forecast as mostly unchanged.

- New business interest is still fairly muted. The no-programmer diffusion index (a measure of the amount of new business available in the marketplace) remains essentially neutral (47.7). This index has gone back and forth between positive and negative over the past two years.

SECOND-QUARTER 2025 LINEN RENTAL SURVEY HIGHLIGHTS

- Rental Revenue Trends. 42% of respondents cited rental revenue trends above expectations in the second-quarter survey versus 21% below (37% met expectations). Thus nearly 80% of survey respondents were at or above expectations.

- No-Programmers. No-programmer interest held positive in the second quarter at 55, its third positive reading in a row.

- Growth Outlook. Forecasted 12-month revenue outlook was a bit lower in the second quarter (at 3.7% versus 4.6% last quarter). Growth expectations were steadily in the 5-6% range post-COVID recovery, showing steady moderation over the last 18-24 months.

Healthcare operators reported that 92% had revenues at or above last year’s levels in the survey, with 23% reporting revenues 5% or more than last year’s levels. Only 8% of healthcare operators reported revenues less than 5% below last year’s levels.

Survey participants include senior executives at linen, uniform and facility services companies across the United States, with some operations in Canada and other international locations. The total response pool includes nearly 500 independent firms.

Click here to view the full report. If you have any questions or comments, or would like to participate in the survey moving forward, contact Baird Senior Analyst Andrew Wittmann at awittmann@rwbaird.com or Senior Research Associate Justin Hauke at jhauke@rwbaird.com.

Sign Up For Our Newsletter

Receive the latest updates on the linen, uniform and facility services industry from TRSA delivered straight to your inbox.