Robert W. Baird & Co. and TRSA recently released the results of their Third-Quarter 2024 Uniform & Linen Rental Survey.

Key uniform rental survey findings include:

- Revenues broadly fell short of expectations. 46% of respondents reported revenues falling short of expectations in the third quarter, with an additional 46% of respondents reporting revenues in-line with their expectations. Only 8% of respondents beat their company’s internal expectations. The beat/miss gap (-38%) is the widest gap since the peak-COVID-19 period that occurred from the second quarter through the fourth quarter of 2020. This measure has been negative in three of the past four quarters.

- Add/Stops remain negative. Employment-driven expansion at existing accounts (i.e., the Add/Stop Diffusion Index) turned negative at 47.1 last quarter for the first time since December 2020 and saw a further decline in the third quarter at 38.5.

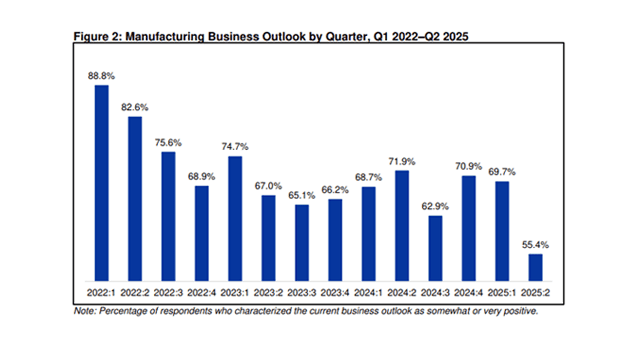

- The revenue growth forecast is at its lowest level since COVID. Respondents expect a roughly 2.8% rental revenue growth over the next 12 months, a steep downtick from nearly 5.5% last quarter (unusually high) and previously steady in the 4.0-4.5% expectations.

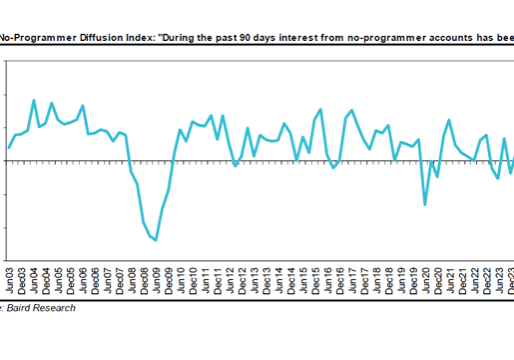

- Positively, new business interest remains strong. The no-programmer diffusion index (a measure of the amount of new business available) strengthened to 67.4 in the third quarter (from 55.9 in the second quarter). This index has been vacillating between positive/negative.

Key linen rental survey findings include:

- Rental Revenue Trends. 47% of respondents cited rental revenue trends below expectations in the third quarter with just 13% beating expectations (and 40% in-line with their company’s expectations). This was the first quarter in which more respondents saw revenue trends below expectations than above since March 2021.

- No-Programmers. No-programmer interest dipped in the third quarter to 43.3, its first negative (i.e., 50) reading since December 2020. This contrasted with uniform rental’s strong positive reading this quarter.

- Growth Outlook. The forecasted 12-month revenue outlook saw significant moderation, and is now expected to grow 2.1% versus 4.7% last quarter. Growth expectations were steadily in the 5-6% range post-COVID recovery, showing steady moderation over the last several quarters.

Survey participants include senior executives at linen, uniform and facility services companies across the United States, with some operations in Canada and other international locations. The total response pool includes nearly 500 independent firms.

Click here to view the full report. If you have any questions or comments, or would like to participate in the survey moving forward, contact Baird Senior Analyst Andrew Wittmann at awittmann@rwbaird.com or Senior Research Associate Justin Hauke at jhauke@rwbaird.com.

Sign Up For Our Newsletter

Receive the latest updates on the linen, uniform and facility services industry from TRSA delivered straight to your inbox.