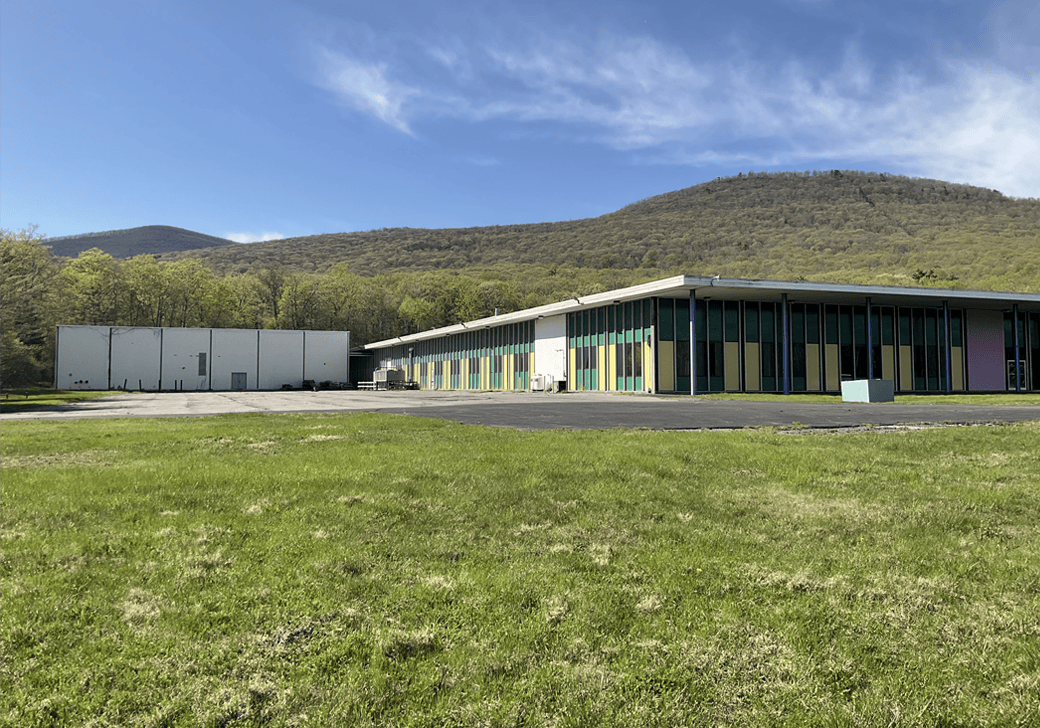

Textile Services Weekly recently toured the Elis SA plant located in Clisson, France, about two hours southwest of Paris. After our walk-through, we sat down with two company executives for questions on a range of issues facing this global company based in St. Cloud, France. Excerpts of our talk with Communication Director Florence Du Chesne and Engineering, Purchasing and Supply Chain Director Frédéric Deletombe, follow.

Is business in Elis’ key sectors – hospitality, healthcare and industrial – steady or growing in France?

France achieved an organic growth of 3.3% in 2024, driven by a combination of volume and pricing. Although some end-markets in France are already relatively well outsourced, we continue to see organic growth opportunities across our various business lines: We have still a lot of new hotel projects, nursing homes, as well as clean room customers. Workwear activity is progressing significantly.

How is inflation impacting the EU economy, especially France?

In the EU, inflation has gradually declined since its 2022–’23 peak, easing pressure on households and moderating price increases across goods and services. In France, inflation has fallen to around 1.1%, thanks to lower regulated electricity prices and cooling services inflation. Analysts expect it to average roughly 1-1.3% this year. This disinflationary backdrop has improved real wages – rising faster than prices – and modestly boosted consumer spending. However, tight fiscal policies, weak external demand and lingering inflation in services continue to constrain growth in France (~0.6 % in 2025).

Are you finding it difficult to get or retain labor for the plants in France?

Recruiting and retaining the labor in laundries has always been a key subject for us, as well as the quality of people and values, service sense, which are part of our recruitment criteria. Maintenance and logistic roles are the tightest roles to fill. We make a constant effort to increase the comfort of work in our laundries (automation of physically intensive tasks, work environment, HR care), as well as invest in equipment, tools and software, helping to professionalize their work and increase their interest. To attract and retain people, we also develop our employees by training them and working on their career development at every level.

The Clisson plant already has automated sorting from Inwatec for finished textiles. Is there a soil-sorting option that you’re considering?

We are always careful before deploying innovations in our laundries to make sure they are reliable and seamlessly working in our laundry environment. The Clisson laundry is built for an easy uplift of the capacity for both flat linen and workwear activities that will allow further automation levels. For flat linen, we currently have pilots in other laundries with different suppliers of towel-feeder robots, and on linen recognition and counting. We expect the towel-feeder robots to be qualified for the next investment in the Clisson plant, and will keep space available for the soiled-linen recognition system until it’s fully validated. For workwear, all articles are RFID (radio frequency identification) tagged. The soiled sorting is already fully automated on one line: separator robot + intruder objects scanner + chip reader and sorter + CBW (tunnel washer) loading, and partially automated on a second line (same but without scanner and CBW automated loading). We think about upgrading the second line with a scanner, as a good investment and return compromise.

Are there any ideas you can share with your U.S. counterparts that could encourage U.S. hoteliers to rent linens, as is common in Europe?

Transitioning to a rental model means embracing a full-service solution that enhances linen quality, availability and operational ease for hotels, with a true win-win partnership.

- We handle the linen investment among a diverse range of linen products, ensuring consistent quality, durability and timely renewal. We maintain stock levels tailored to each customer’s needs, eliminating the burden of linen purchasing, storage and supply-chain management for the hotel.

- We guarantee professional laundering with high standards for washing, drying and finishing – all environmentally optimized to use minimal water, energy and detergents. Our fully controlled process is tailored to the rented textiles and handled in optimized batches, unlike the fragmented and less-efficient approach seen with mixed or unknown items in traditional models.

- We eliminate the need for in-house laundry operations, saving hoteliers from the hassle of managing space, staffing, compliance safety issues and unpredictable costs – not to mention ensuring better business continuity.

- We ensure reliable and timely deliveries through our dedicated service agents, who operate on regular, dependable schedules, bringing the right linen precisely when needed.

Is Elis still interested in entering the U.S. and/or Canadian market?

The U.S. market is the largest in the world, and we have historically monitored potential opportunities there, as we do in many countries where we are not yet operating. In 2024, we held brief discussions with two major players in the workwear market, that should have stayed confidential at those early stages. However, we ultimately decided to end those conversations, as neither met our investment criteria. As of today, a short-term entry into the U.S. market is therefore highly unlikely. We are of course closely monitoring this great market.

What’s Elis’ vision for sustainability in 2025? Take fleets for example. Do you anticipate that Elis will go entirely with alternative fuels at some point?

- In 2025, we will reach about 10% of our distribution fleet with alternative-fuel vehicles, mostly electricity and biofuel powered. We have a pragmatic approach, taking into account the payback, the reality of potential city constraints or customer requests. So it’s not planned to convert all the fleet to alternative fuels, even though maintaining a decent yearly pace.

- On water and gas, we should not be far from our targets of -50% intensity (water, l/kg), and -35% intensity (gas, kwh/kg) vs. 2010 (European laundries reference)

- We also have multiple additional actions in place related to our SBTI (Science Based Targets Initiative to reduce environmental harm) and global CSR (corporate social responsibility) strategy.

About Elis …

Elis is a French industrial laundry group that’s one of the world’s largest companies in this sector, recently joined TRSA. The company’s Chairman and CEO Xavier Martire also recently joined TRSA’s Board of Directors. Elis is known for its comprehensive range of services, including linen and workwear rental, well-being services and pest control. Key metrics include:

- Number of Plants: Elis operates more than 487 production and service centers worldwide

- Employees: The company employs approximately 57,000 people

- Yearly Income: In 2024, Elis reported a revenue of around $5.6 billion (4.5 billion euro)

- Countries of Operation: Elis is present in 31 countries across Europe and Latin America

- Customers: More than 400,000

Elis’s business model is based on the circular economy, emphasizing sustainability and the reuse of products. They offer customized solutions that help customers avoid making direct purchases of products, extending the service life of items and promoting environmental responsibility. Watch for follow-up coverage of Elis and the Clisson plant in upcoming issues of Textile Services magazine.

Sign Up For Our Newsletter

Receive the latest updates on the linen, uniform and facility services industry from TRSA delivered straight to your inbox.