In a landmark victory for the linen, uniform and facility services industry, Texas Gov. Greg Abbott (R) has signed SB 2774/HB 1769 into law – legislation championed by TRSA that redefines how the industry is taxed and recognized under state law.

A Tax Code Victory for Essential Services

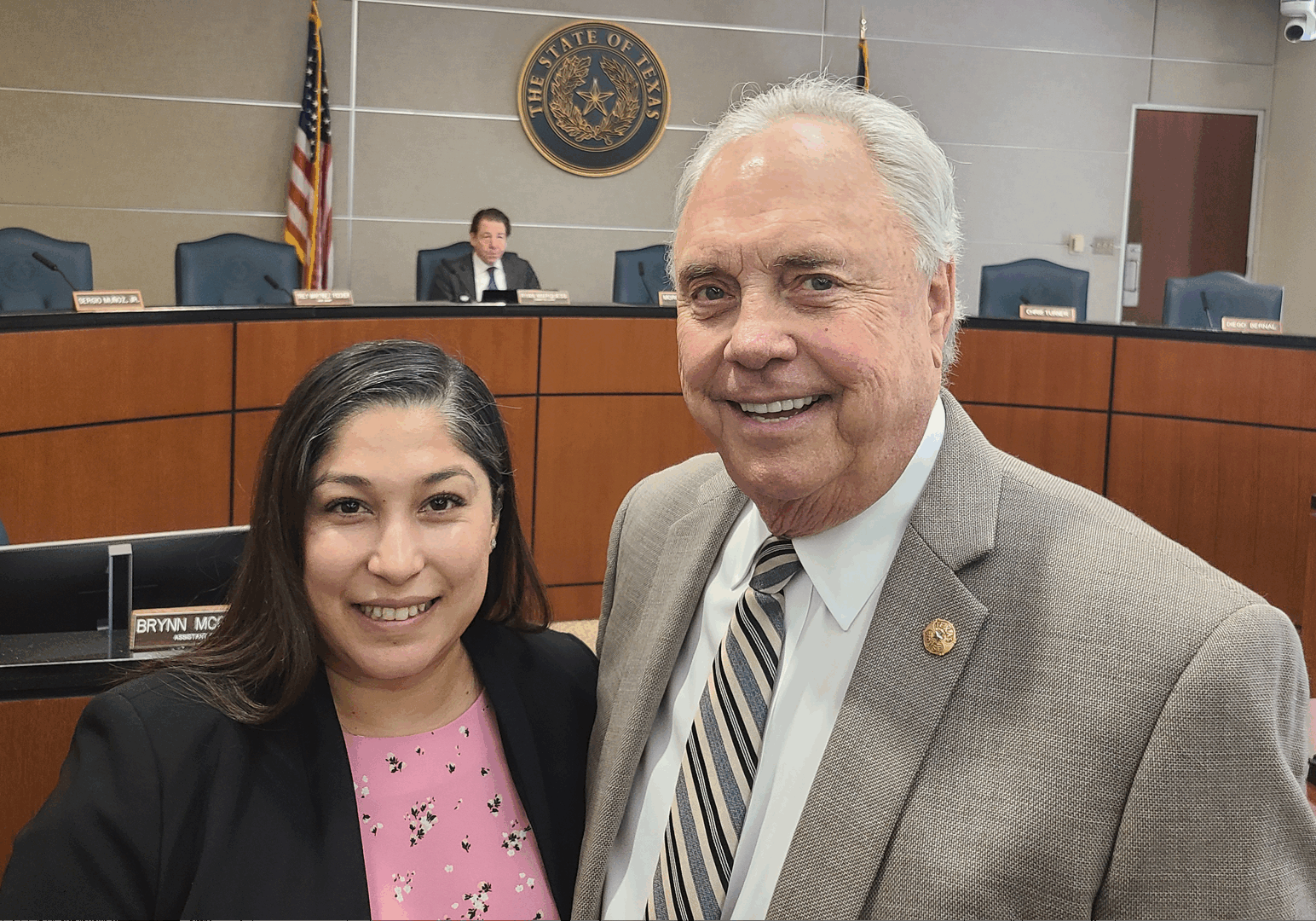

SB 2774, authored by State Sen. Adam Hinojosa (R), and its companion bill HB 1769, led by State Rep. Drew Darby (R) [pictured above, right], amend the Texas Tax Code to reclassify businesses in the linen and uniform rental sector under the “retail trade” category. This change allows these businesses – classified under SIC codes 7213 and 7218 – to qualify for a reduced franchise tax rate of 0.375%, down from the previous 0.75%.

This adjustment aligns the industry with other rental sectors, such as formalwear, which already benefit from the lower rate. The result is a more equitable tax structure that acknowledges the essential nature of the services provided by TRSA members, including support for healthcare, hospitality and the emergency-response sectors.

TRSA’s Advocacy in Action

The passage of this legislation is a direct result of TRSA’s persistent advocacy and grassroots mobilization. This is the third time TRSA has made the effort to change the tax code. During the 2025 Texas Legislative Day, TRSA members from across the state engaged in what Vice President of Government Relations Kevin Schwalb called “shoe-leather lobbying” – meeting with lawmakers, sharing industry insights, and emphasizing the economic and public service value of their work.

“This is a huge win for our industry,” Schwalb said. “It’s not just about tax fairness – it’s about recognizing the critical role our members play in keeping Texas running.”

Economic and Operational Impact

The linen, uniform and facility services industry is a vital part of Texas’s economy and infrastructure. According to TRSA’s Industry Performance Report:

- The industry generates over $40 billion annually nationwide, with Texas representing one of the largest state markets.

- More than 20,000 Texans are employed in this sector, with jobs ranging from route service representatives to plant engineers and customer service professionals.

- Productivity benchmarks show that the average TRSA member processes over 50,000 pounds of textiles per week, supporting industries such as healthcare, food service and manufacturing.

- Energy- and water-efficiency improvements have led to a 30% reduction in resource consumption over the past decade, underscoring the industry’s commitment to sustainability.

Benefits of the New Law

The reclassification and tax relief will have immediate and long-term benefits for the industry:

- Capital Reinvestment: Businesses will have more financial flexibility to invest in equipment, technology and workforce development.

- Job Creation: Lower tax burdens can lead to expansion and hiring, particularly in underserved or rural areas.

- Service Expansion: With increased resources, companies can better meet the growing demand for hygienic, reliable textile services across Texas.

“While this is a total team effort, a special recognition goes out to TRSA Board Members Theresa Garcia, COO of Division Laundry (pictured above, left); and Roger Harris, CEO of Metro Linen, for taking extra time out of their calendars to travel to Austin to testify in front of the respective committees,” Schwalb said. “We were also fortunate to have on our team, Jesse Ancira and Carolyn Saegert of Ancira Strategies, to be our ‘boots on the ground’ in Austin. Without their persistent efforts and leadership we would not have been able to achieve this great success.”

TRSA’s success in Texas sets a precedent for similar legislative efforts in other states. It also reinforces the importance of industry engagement in public policy. As TRSA continues to advocate for fair treatment and recognition of its members, the passage of SB 2774/HB 1769 stands as a testament to what can be achieved through unity, persistence and strategic advocacy.

Sign Up For Our Newsletter

Receive the latest updates on the linen, uniform and facility services industry from TRSA delivered straight to your inbox.