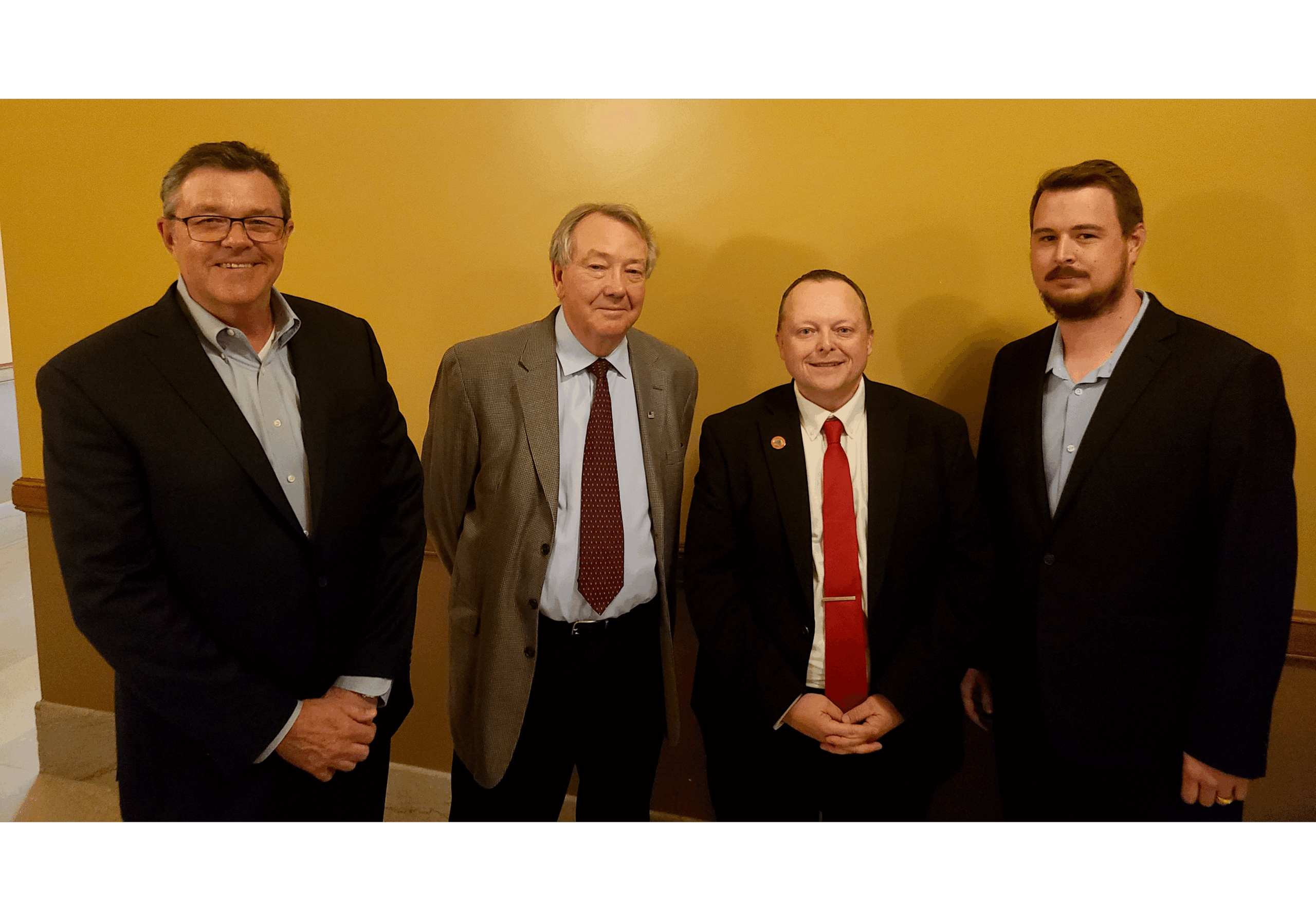

Members of TRSA and the Wisconsin Association of Textile Services (WATS) pushed AB 187 further down the track by participating in the Wisconsin State Committee on Ways and Means hearing.

The delegation, comprised of Andrew Leonard, Gunderson Uniform and Linen; Dave Jerrett, Bay Towel; and Jim Leef, ITU AbsorbTech, testified on behalf of the legislation. The bill aims to add the linen, uniform and facility services industry SIC codes to the Manufacturing and Agricultural Tax Credit (MATC) in Wisconsin.

The legislation’s Assembly Sponsor, Assemblyman Scott Krug, led the hearing in support of the legislation and was followed by the TRSA trio.

“As stakeholders deeply rooted in Wisconsin, we recognize the profound importance of investing in our people, and our state,” said Leonard to the committee. “The proposed tax credits in Senate Bill 177 will provide us with the financial means to reinvest in our workforce and contribute meaningfully to the economic development of Wisconsin.”

Jerrett, the CEO of Bay Towel, added that, “Most everything we do is recyclable and reusable, the only option is disposable, which goes directly to a landfill; our process takes unusable items, takes them through an environmentally friendly mechanical process and produces a usable item, the definition of manufacturing. We are asking for your help in leveling the economic playing field in terms of tax treatment.”

Kevin Schwalb, TRSA’s vice president of government relations, said that, “This is a great start, next week will be a busy week. We hope the Ways and Means Committee passes the bill and the Senate Committee on Universities and Revenue will have a hearing on the Senate version of the legislation, SB 177. This is proof that TRSA member involvement pays off.”

Pictured above, left to right: Dave Jerrett, Jim Leef, Scott Krug and Andrew Leonard

Sign Up For Our Newsletter

Receive the latest updates on the linen, uniform and facility services industry from TRSA delivered straight to your inbox.