TRSA recently announced findings from its latest membership survey. A total of 127 respondents weighed in on issues ranging from association lobbying to its publications, training and certification programs, events and more. The responses were decidedly positive – most respondents said that TRSA provides a strong return on investment.

When asked in the survey conducted by Strategic Insight Partners, Findlay, OH, as to the value of TRSA membership, 35% of operators said the association provides “excellent value,” while 58% said TRSA provides “very good value.” The numbers were virtually unchanged from a similar survey conducted in 2023. As for supplier partners, the responses were similarly positive with 32% saying TRSA provides an “excellent value,” while 53% said it provides “very good value.”

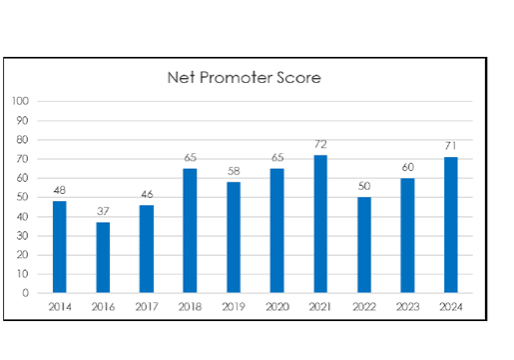

The association also received high marks in terms of its Net Promoter Score (NPS). This metric measures on a 1-10 scale the percentage of respondents who scored a 9 or 10 (promoters) and subtracts that figure from the percentage of respondents who scored TRSA as a 1-6 (detractors). The survey notes that the “Net Promoter Score is based on a theory that respondents can be categorized into three groups (promoters, passives and detractors).” In this latest survey, TRSA operators gave the association a NPS score of 71, a single point below the highest-ever figure of 72 that was recorded during the COVID-19 pandemic year of 2021. An NPS score of 50 or higher is considered excellent. The NPS scores for TRSA supplier partners registered 73 for this year – the highest ever recorded. That number is up from 66 in 2023. The combined score of both operators and supplier partners was very similar to the scores recorded for the individual operator/supplier categories. The combined 2024 NPS score of 71 was just a shade below the all-time high score of 72 in 2021. “These survey findings confirm that TRSA is filling an important role for the linen, uniform and facility services industry,” said TRSA President and CEO Joseph Ricci. “There is little room for doubt that both our operator and supplier partner members are getting value for their investment in TRSA. We look forward to building on these results to provide even greater ROI for TRSA members going forward.”

The survey also allowed respondents to offer verbatim comments on the various questions raised about TRSA and its programs. While small in number, these too were overwhelmingly positive. Respondents served up praise for TRSA’s lobbying program and its print magazine, Textile Services. One respondent quipped that Ricci should consider running for national office. “Joe Ricci for president in the U.S. at the next elections!” one respondent wrote. Another noted that taking the Production Management Institute (PMI) program 20 years ago has greatly advanced that individual’s career. The Executive Management Institute (EMI) got a similar thumbs up from a respondent who said it had greatly benefited that individual’s 39-year career in the industry. A third respondent noted that the value that members get out of TRSA hinges on how engaged they are in its programs. “In my experience, rewards received from membership are proportionate to your level of membership participation” the respondent said.

Other survey highlights include:

- Among the membership’s demographics, a chart underscored TRSA’s diverse membership in terms of company size. For example, 28% of the respondents said that their 2023 gross revenue was $20 million to $49.9 million. The next-largest category at 23% was companies that reported 2023 gross revenues of $10 million-$19.9 million. After that, were companies with $500 million or more in gross revenue (16%) and at 13%, companies with $50 million to $199.9 million (13%).

- The survey asked respondents about their ages in terms of their membership in various “generational cohorts.” For example, the largest demographic group among the respondents was from “Gen X” (born 1965-1979) at 42%. The next-largest is “baby boomers” (born 1946-1964) at 34% and “millennials” born 1980-1995 at 22%.

- The survey also asked the top three reasons “Why your organization maintains membership in TRSA.” In a combined response from both operators and suppliers, the top three reasons for membership include: Industry Networking (a “first choice” for 45% of respondents; Sharing Industry Best Practices (a “first choice” for 22% of respondents); and gaining company/plant certification (a “first choice” for 19% of respondents).

Anyone with questions about the survey, including its take on members’ use of social media, may contact TRSA’s Director of Membership/Industry Outreach Ken Koepper at kkoepper@trsa.org.

Publish Date

May 31, 2024

Categories

Sign Up For Our Newsletter

Receive the latest updates on the linen, uniform and facility services industry from TRSA delivered straight to your inbox.