Addressing consequences to businesses of fast-moving shifts in international relations (especially tariff implementation), an Aug. 6 TRSA webinar improved laundry operators’ and suppliers’ insights into macroeconomic drivers emerging from these.

Sponsored by the TRSA Supplier Partner Council, the presentation gave members pointers for adjusting processes in supply-chain management, scenario planning, financial analysis and technology adoption. Improvement in these functions is considered vital to managing the uncertainty created by tariffs, geopolitical strife and immigration reform.

TRSA members: View this webinar’s recording at no charge here. Webinar presenter Rick Ponthan noted that while impacts of these are likely to be negative, they may be mitigated by improving processes, taking advantage of tax reform and adopting emerging technologies.

Ponthan, a 40-year veteran of linen and workwear service (AmeriPride, Vestis, Alsco) and supply (Workwear Outfitters), urged webinar participants to remain vigilant of policy shifts and their impacts. He recommended linking to these websites to stay ahead of the trends.

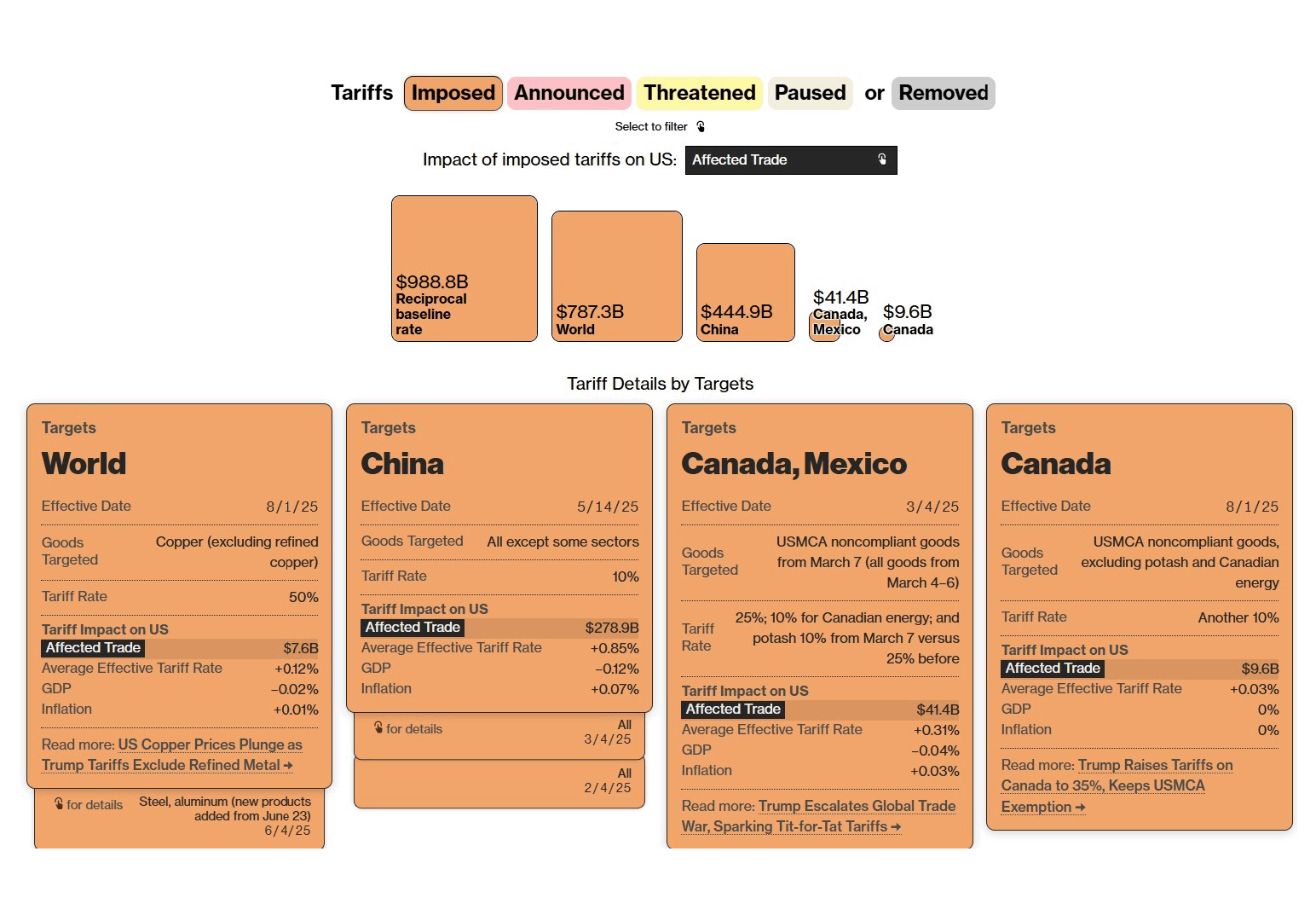

Tariffs’ implementation. Go to Bloomberg.com and search “tracking every tariff” to access updates on those imposed, announced, threatened, paused or improved.

Immigration reform/control. Homeland Security (permanent residence grants, refugee or asylee admissions, immigration enforcement subjects, monthly enforcement metrics); Citizenship and Immigration [for data on legal immigration: petitions and applications (received, approved, and denied), visa and asylum claims, direct tracking of legal pathways]; Customers and Border Protection (encounters, apprehensions: monthly releases, irregular migration indicator).

Credit conditions (impacted by tariffs and geopolitical strife). Standard & Poors (S&P) Global Credit Ratings: credit risks and their potential ratings impact in various asset classes, borrowing and lending trends for businesses and consumers.

Domestic energy production. U.S. Energy Information Administration: data and projections on all energy sources, including electricity, natural gas and petroleum; wholesale electricity and natural gas market data; long-term trends and short-term factors that affect prices; fundamentals of supply and demand – key drivers of price volatility.

Tax code and regulatory. Tax Foundation: nonpartisan research and detailed analyses of new legislation to help businesses anticipate impacts on their industry and operations. However, Ponthan noted there are no more definitive sources of tax guidance than the IRS and your tax adviser.

Sign Up For Our Newsletter

Receive the latest updates on the linen, uniform and facility services industry from TRSA delivered straight to your inbox.