Industrial Roundtable Covers Marketing, Fleet, Wastewater Issues

Opportunities for uniform service growth were highlighted in TRSA’s recent Industrial Research and Roundtable session. It featured data presented by the Yes& agency, TRSA’s consultant on its Market Recovery and Expansion project, from the portion of this consumer and decision-maker research most relevant to the industry’s industrial sector.

Findings discussed included data that quantifies the degree to which uniforms convey quality, safety and confidence to consumers of wearer businesses. Chief among those that benefit from uniforms’ value for conveying trust, for example, are utilities, delivery services, restaurants, home services and auto repair. This impact is greater for these industries than retailers who outfit their salespeople.

Jay Rasmussen, a former Ameripride Services executive now consulting in the industry, discussed the data’s practical implications. When Logan Murtha, Yes& creative strategist, observed that 90% of the surveyed consumers who are uniform wearers are responsible for laundering their own, Rasmussen indicated this suggests potential for promoting uniforms as an employee benefit. Payroll deduction plans might become more significant revenue sources for uniform services.

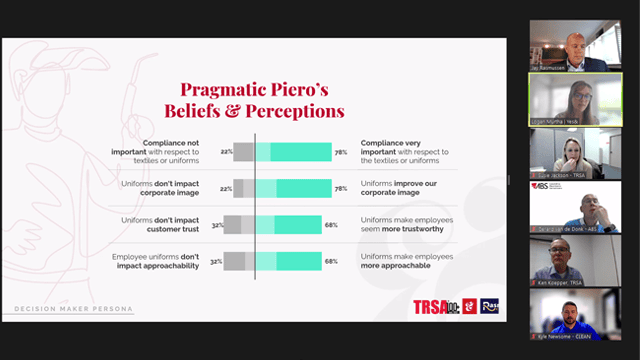

Findings from the survey of decision-makers pointed to the need to improve communication with customers. This includes emphasizing how well the industry serves them in accordance with the data that identifies what matters most to them. In this vein, Rasumussen suggested their concerns about high employee (wearer) turnover indicate the value of providing them with sizing kits and more items available in bulk sizes.

The Market Recovery and Expansion project identifies views, desires and expectations among decision-makers in industries that use linen, uniform and facility services and does the same for these customers’ customers (consumers). The research is fostering messaging and resources for TRSA member companies to support their marketing. Development of a toolkit is underway for members to promote their companies that suggests messaging to increase their attention to the industry. Members are learning about these concepts and tactics through presentations, webinars and reports.

The session also included dialogue among participants akin to an in-person roundtable discussion in which they raised a variety of concerns, especially regarding COVID-19 induced labor and supply chain issues. They were presented with data specific to the industrial sector on these issues from recent Robert W. Baird & Co. and TRSA Business Pulse surveys.

Kevin Schwalb, TRSA government relations VP, addressed current legal concerns likely to spread from California to other states. This includes requirements to electrify delivery vehicle fleets. In “last-mile delivery” businesses such as linen and uniform service, fleets must be 10% zero-emission by 2025. That figure rises to 25% in 2027 and 50% by 2030. Pete Buttigieg, U.S. transportation secretary, is watching closely.

Schwalb added that a bill is brewing in the state legislature that would require all washing machines sold there to filter microplastics. This follows four years of successful efforts to protect the industry as industrial dischargers from any legislation to require such filtration. “More state legislatures are picking up on microplastics issues,” he said.

A wastewater discharge issue on TRSA’s national radar involves per- and polyfluoroalkyl substances (PFAS), chemicals used in numerous products including flame suppressants that can be found in workwear. Publicly owned treatment works have asked industrial laundry operators about their use of textiles containing PFAS. The U.S. Environmental Protection Agency (EPA) is considering factoring PFAS into new drinking water standards.